cover image: amazon

Amazon recently announced an intriguing new “solution” to business security – repurposing its lackluster Astro domestic robot as a mobile security camera for stores, offices, and warehouses. On the surface this seems like a creative pivot for a product that failed to gain traction in homes. But a deeper look at the economics, practicalities and overall US burglary statistics suggests this may be less of an innovative advance in security and more a case of attempting to squeeze revenue from an underwhelming gadget.

Let’s dive in a bit deeper.

TL;DR / Summary

- Amazon rebrands its failed Astro home assistant and guard dog as a business security solution.

- The same reasons the bot proved unpopular with homeowners will likely carry through to business (and then some…)

- There is little / no compelling argument for wheeled robot business security at this time.

- This seems less like a smart security product strategy and more like a desperate attempt to wring profit from a failed product line.

What’s Amazon Proposing with Astro for Business?

The basic pitch is that Astro can autonomously patrol your small or medium-sized business after hours looking for intruders. It streams video via your WiFi network to the Astro app on your phone, sending alerts if it detects people or significant motion. Amazon is aiming for broad compatibility with existing business security systems and promising regular over-the-air software updates to expand Astro’s functions.

Standard pricing is $2350 up front (an almost $800 markup from the “consumer” version) per 5000-square foot patrolling bot, at an estimated $80 / month cost including Ring service and Astro Secure Service, plus up to $100 / month for real time access to responders, for around $180 / month total. Assuming a conservative 3-year replacement window, we’re talking about ~$2400 per year, per bot.

Sounds good on the surface, but how do things work today, by comparison?

Business Security Now Relies Heavily on Humans

According to the Bureau of Labor Statistics there are over 1.1 million security guards employed across a subset of the 33.2 million businesses in the US, with the majority being employed in commercial settings. Large retail chains, banks, warehouses and office parks commonly have dedicated overnight security staff. Smaller main street shops and restaurants typically rely on local private security firms for periodic monitoring.

Industry estimates suggest 25-50% of all US businesses contract some type of overnight security services, whether human or electronic. That percentage rises for companies in higher risk urban areas or those handling valuable goods.

Exact costs vary based on hours, responsibilities, and local wages, but to put this general cost into perspective, the average hourly wage (2023) for a security guard in the United States is ~$18. Assuming a 40-hour workweek, this translates to an annual cost of approximately $36,000 per security guard.

With US businesses spending that much per head, or $7 billion annually, on security guards, this sounds like a slam dunk, with some tasty revenue on the table that Amazon no doubt hopes to siphon.

But not so fast…

Making an Apple to Oranges Comparison

image: kariiika & interactimages

At first blush those cost savings look enticing. But we’re really comparing apples and oranges when looking at humans versus Astro. That dedicated security guard is physically surveilling premises, able to investigate disturbances and confront intruders. Astro only alerts to motion – by the time police arrive the burglars (and your valuables) may already be long gone. With the average burglary in the US lasting between 8 and 10 minutes – and only ~ 30% of police responses to a burglary happening in under 10 minutes – Astro provides a narrow gap even if you do opt for the additional subscription to add real time alert monitoring by a human.

On the flipside, the presence of a guard can be a deterrent – in ~60% of cases, thieves will bypass a property with an obvious alarm.. and the presence of a physical, uniformed human provides an obvious visual cue to “alarm”, much moreso than a small, wheeled, cute robot does.

And what about liability? With a contracted guard company a business can transfer some responsibility legally, depending on the specific contract. If a break-in occurs despite what the business sees as reasonable precautions, some or all of it might be security company liability. With Astro, you adopt legal accountability for properly configuring, monitoring and responding to the robot’s alerts. Failure to do so diligently could make you culpable and ultimately leave you on your own – Amazon’s terms and conditions will ensure this.

image: isaac1112

This also says nothing of the consulting advice and other inputs you might get from a security firm – aside from pure guards, they might recommend other changes to your space / setup to minimize risk. Additional lights. Better locking mechanisms, superior camera setups, etc. Astro won’t do that for you. But hey, it can play a cute slideshow from your company Facebook, so that makes up for it, right?

There are also practical integration challenges. For Astro to work it needs strong WiFi coverage across your facilities and sufficient network bandwidth to stream HD video. For many small retailers and professional services firms, that will require infrastructure upgrades (is the Wi-Fi strong in the back of the stockroom / warehouse?). And that assumes literal integration and maintenance is “Free”, which is obviously a very “sunny day” prediction.

Logistically… what about stairs (which Astro can’t climb) and confined spaces or stock rooms the robot can’t access? Doors which are standardly kept closed / secured? Human guards have freedom of movement and observation powers no current toddling robot can match.

The Math Just Doesn’t Add Up

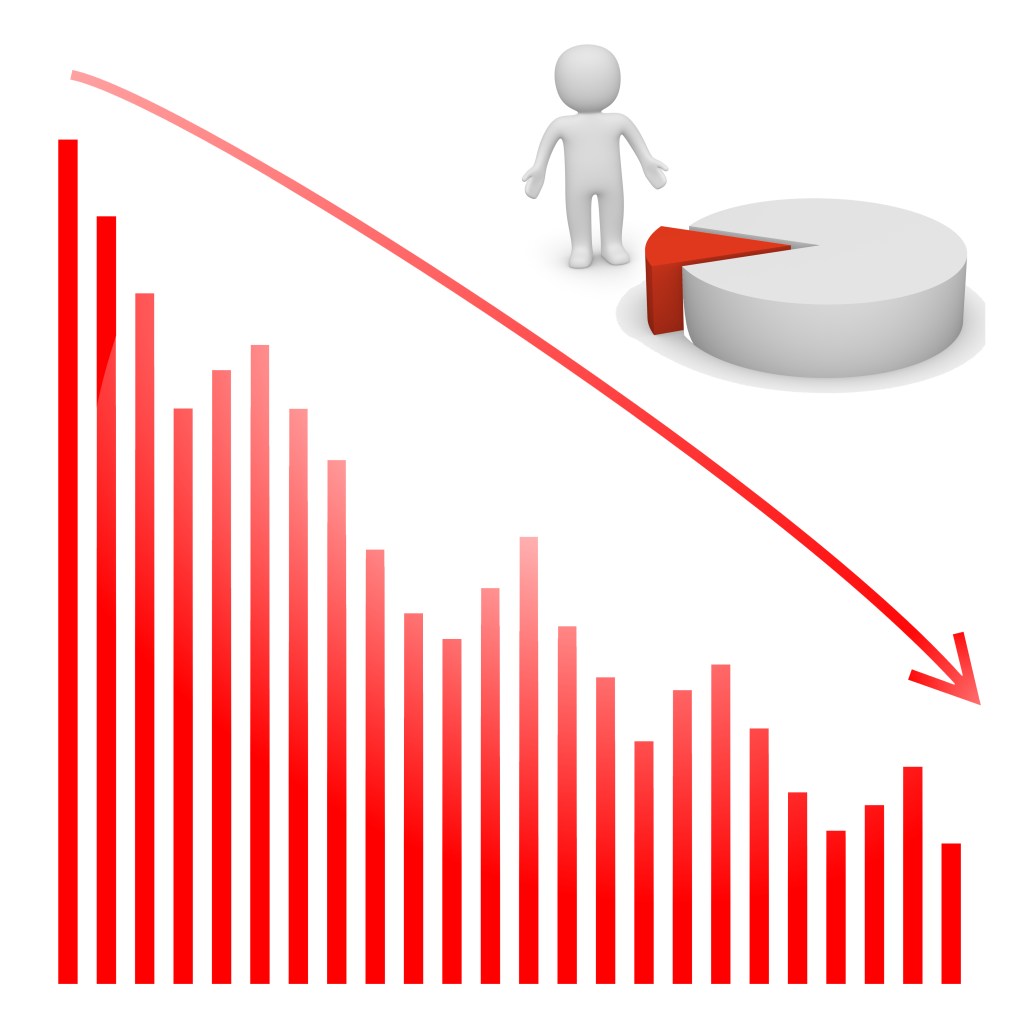

image: Viktor-88 and hurgem

But perhaps the biggest flaw in Amazon’s sales pitch is that businesses simply don’t suffer the majority of burglaries and thefts. FBI statistics consistently show that of the 1.1 million US break-ins 2021, 62.1% targeted residential properties, even though valuable commercial stock and cash may seem enticing.

Occupied homes with often minimal or nonexistent alarm systems present opportunistic burglars with a soft target (And this is probably part of why Amazon’s pitch to sell Astro as your home security buddy ultimately failed). In contrast, commercial properties typically have extensive intrusion detection systems, secured goods and limited cash on site. With under 20% of total burglaries, businesses simply aren’t statistically likely victims.

And doubling down on security further reduces those already low odds. So in most cases that $30-$60,000 a year for human guards provides only a marginal improvement in safety – protecting against an unlikely event. Shifting to a rent-a-robot like Astro offers ambiguous benefits beyond existing systems, albeit at a cost savings, but with also unknown onboarding and integration costs and potential long term downsides. It also turns a traditionally vendor management problem into an IT problem, which an organization might not be well positioned to do.

More Margin Protection than Loss Prevention

Stepping back, Astro for business seems less a game changer innovation and more a tactic to reclaim sunk costs on an underwhelming product. With estimated parts costs over $500 per unit, and not-insignificant monthly maintenance, Astro simply didn’t deliver enough utility for consumers. But pitched as a business expense, the economics get murkier.

Amazon senses an opportunity to salvage an otherwise unsuccessful product – or so it seems. Yet it’s doubtful many frugal small business owners will buy into the still unproven concept. When spending thousands annually to ward off rare break-ins, more time-tested (and, in the cases of alarms, cheaper) measures usually suffice.

imagine: IgorVetushko

And for most larger firms, Astro’s limitations coupled with liability, lack of professional services, and integration headaches just don’t present a compelling value proposition. Robots roaming your grocery store or car lot may look cool in promo materials. But physical security theatre doesn’t equal actual loss prevention.

On the corporate support side, things are worrying. Astro has been, since its launch 2 years ago, invite-only, and remains that way today. Moreover, with Amazon’s VP of consumer robotics recently departing, and the bot notably absent in a recent consumer device showcase, businesses would be right to be wary of investing in what may be a short-term gimmick.

In the end, this robot pivot satisfies a corporate desire for monetization much more than main street’s need for protection. With little hard evidence Astro can meaningfully outperform humans or dramatically reduce property crime, Amazon’s business security solution feels like it’s still searching for a problem – or at least some marginal profit.

What are your thoughts? Have we finally found the first area where “the robot overlords” will replace blue-collar workers? Or is there no real case here, and just another example of AI and robotics hype far outselling the practical reality?

Additional Sources

- ADT

- Department of Justice

- SafeatLast.co

- Crime Data Explorer

- SafeWise

- Reolink

- UNC Charlotte

Leave a comment